|

||||||||

|

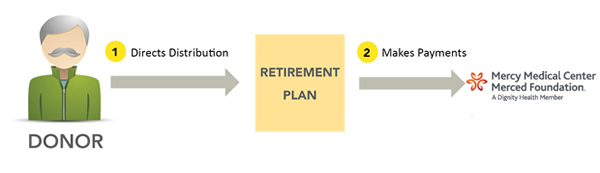

Gifts of Retirement Plans

How it works

![]() You name the Mercy Foundation as the beneficiary of your retirement plan.

You name the Mercy Foundation as the beneficiary of your retirement plan.

![]() Any residual left in your plan when you die passes to the Foundation tax-free.

Any residual left in your plan when you die passes to the Foundation tax-free.

Benefits

- Avoid the potential double taxation your retirement savings would face if you designated them to your heirs.

- Continue taking lifetime withdrawals.

- Maintain flexibility to change your beneficiary if your circumstances change.

Consider a gift from your retirement plan if you:

- Have a 401(k) or other retirement plan you want to gift to the Mercy Foundation through your estate plan

- Have an IRA plan you want to gift directly to a the Mercy Foundation and you want the Mercy Foundation to help facilitate the gift

- Want to balance your giving between providing for your family and for the community

- Want to ensure the most efficient distribution of the assets in your estate

Related Links

More about gifts of retirement plans

Gift example

For assistance with this gift plan, please complete the request information form or contact the Mercy Foundation at (209) 564-4200 or e-mail to MercyFoundationMerced@DignityHealth.org.