|

||||||||||

|

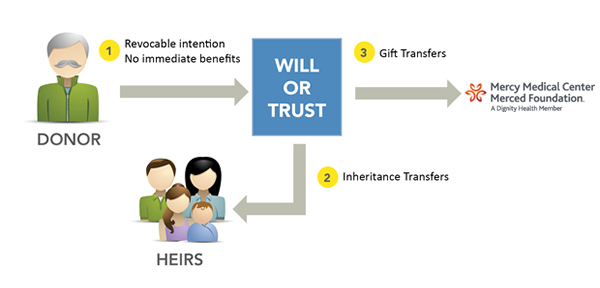

Gifts by Will or Trust

How it works

![]() You can make a future gift to the Mercy Foundation now by including a bequest provision in your will or revocable trust.

You can make a future gift to the Mercy Foundation now by including a bequest provision in your will or revocable trust.

![]() Your will or trust directs assets to your heirs.

Your will or trust directs assets to your heirs.

![]() Your will or trust directs a bequest to the Mercy Foundation for the purpose(s) you specify.

Your will or trust directs a bequest to the Mercy Foundation for the purpose(s) you specify.

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your bequest if your circumstances change.

- You can direct your bequest to a particular purpose (please check with the Mercy Foundation to ensure your gift can be used as intended).

- There is no upper limit on the estate tax deductions that can be taken for charitable bequests.

- You can feel assured that your bequest will support the Mercy Foundation in the way you intended when you are gone.

Consider a gift by will or trust if you:

- Want to help ensure the Mercy Foundation's future viability and strength

- Think long-term planning is more important than an immediate income-tax deduction

- Want the flexibility of a gift commitment that doesn't affect your current cash flow

Related Links

More about gifts by will or trust

How to include the Mercy Foundation in your will or trust

Bequest language for your will or trust

Will Planning Wizard

For assistance with this gift plan, please complete the request information form or contact the Mercy Foundation at (209) 564-4200 or e-mail to MercyFoundationMerced@DignityHealth.org.